What makes a state landlord-friendly?

Landlord-friendly states have laws, practices, or lower operating costs that benefit the interests of landlords. This does not mean that tenants are mistreated in these states. Rather, landlords have broader authority to properly manage their rentals.

Identifying a state as landlord-friendly is somewhat subjective, as landlords have different opinions about what is most important and helpful to them.

Also, due to municipal laws, different cities within the same state can vary widely in terms of landlord-friendliness.

In this article, we are considering a state as landlord-friendly if it has any of the following characteristics:

1. Low property taxes

Owning real estate comes with costs, including property taxes. According to Wisevoter, the 2023 average property tax rate in the United States was 1.0%.

If a state's average rate is below the national average, landlords may be more inclined to invest there.

2. No rent control

Rent control is legislation that regulates how and when landlords can increase rent. If a state is landlord-friendly, it will not institute rent control.

Many states ban rent control, while others allow municipal governments to pass their own legislation. Oregon is the only state that has passed a statewide rent control law.

3. Fast eviction process

A state's eviction laws usually outline the lease violations that constitute an eviction, and the length of notice landlords must provide.

When a state has laws that enable landlords to rightfully evict tenants in a simple and timely matter, its residents may be more inclined to invest in rental properties.

4. No deposit limits

Some states limit security deposit amounts and give landlords less time to return them.

When landlords do not have adequate time to properly inspect their properties before returning security deposits, they could miss tenant-caused damage and suffer financially.

5. Short notice requirements

Landlords have to enter their rental properties from time to time, whether for inspection or repair. A state's rules regarding the right to enter a rental property can affect a landlord's ability to protect their property.

A state with shorter notice requirements can make it easier for a landlord to manage their properties efficiently, thus making the state more landlord-friendly.

6. Expanded tenant rights

Some state laws grant tenants additional rights that diminish a landlord's full authority. Therefore, the extent of a tenant's rights can affect the landlord's control over their own rental property.

For example, in California, when a landlord is not repairing something in a timely fashion, tenants have the right to make repairs themselves and deduct the cost from their rent.

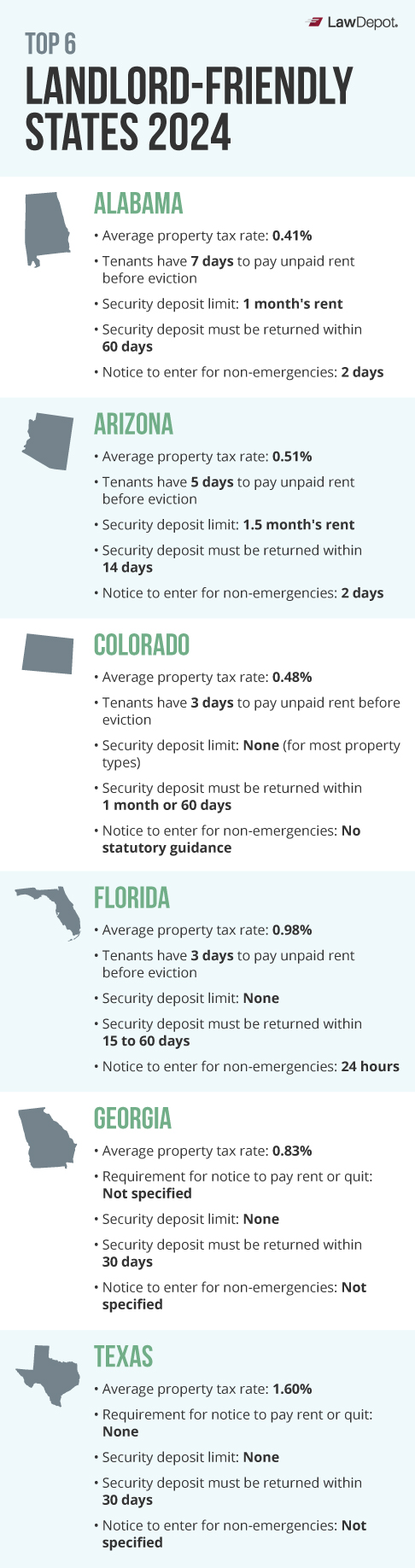

Alabama

Alabama's low property tax rates make it an easy addition to this list. In 2024, it was 0.43%, making it the second lowest in the country. Also, landlords in Alabama do not need a rental license.

Alabama has no rent control laws or policies, so landlords can set any rent amount when establishing a lease agreement. In addition, there are no laws in Alabama that prevent rent increases. Therefore, a landlord can increase their tenant's rent at any time during a periodic tenancy, such as a month-to-month lease. Landlords cannot increase the rent during fixed-term tenancies unless they include the necessary clause in the Lease Agreement and follow its terms.

When it comes to evictions, Alabama's laws enable landlords to protect their own interests. If a tenant doesn't pay rent or violates other lease terms, the landlord can deliver a seven-day written notice to pay rent or remedy the breach. If the tenant does not remedy the issue, the landlord can terminate the lease and pursue an eviction (AL Code § 35-9A-421)

If the tenant commits illegal acts on the property, the landlord may evict them without giving them a second chance. In this case, the landlord must deliver an unconditional notice, informing the tenant that they have seven days to move out.

In Alabama, a landlord cannot charge more than one month's rent for a security deposit (AL Code § 35-9A-201). In addition, if a security deposit is not used to cover tenant-caused damage or unpaid rent, a landlord must return it to their tenant within 60 days of the end of the tenancy. If the landlord does not return the deposit within 60 days, the tenant may be entitled to double the original deposit amount.

Alabama law requires landlords to provide their tenants with at least two days' notice of their intent to enter the rental property. In addition, landlords can only enter the rental property at reasonable times, such as during the day. No law in Alabama permits tenants to withhold rent or deduct a repair cost from a rent payment.

| Alabama | |

| Average property tax rate | 0.43% |

| Notice to pay rent before eviction | 7 days |

| Security deposit limit | 1 month's rent |

| Requirement to return deposit | 60 days |

| Notice to enter requirement | 2 days |

Arizona

Arizona is on our list for various reasons, including its low average property tax rate. According to SmartAsset.com, homeowners in Arizona only pay 0.51% in property tax (as of January 24, 2024).

Landlords do not need a rental license, but they must register their residential rental property with the county assessor where the property is located ( AZ Rev Stat § 33-1902). Individual counties and cities may have their own licensing requirements as well.

Arizona does not have rent control, so a landlord may charge any amount for rent if they outline it in their tenant's lease. In addition, there are no limits to rent increases in Arizona, so landlords can raise a tenant's rent if they include the proper provision in the lease.

Arizona is landlord-friendly because tenants cannot withhold rent for any reason. If a tenant in Arizona fails to pay rent, their landlord may deliver a five-day notice to pay or move out (AZ Rev Stat § 33-1368). If the tenant does not pay the landlord within five days, then the landlord can file an eviction lawsuit against the tenant. Five-day notices also apply to health and safety violations.

For non-hazardous violations, landlords can issue a ten-day notice. If a tenant commits illegal acts within the rental property, such as selling drugs from the rental, their landlord can immediately terminate the rental agreement and evict them.

Many states only allow landlords to charge one month's rent for security deposits. But in Arizona, a landlord can charge up to one and a half months' rent for a security deposit. Unfortunately, if a landlord doesn't use a security deposit to cover unpaid rent or repair costs, they only have 14 days to return it to the tenant. Also, Arizonian tenants can get double what they are owed if the landlord doesn't return the deposit within 14 days. Still, Arizona's low property tax rate and short eviction process make it a landlord-friendly state.

| Arizona | |

| Average property tax rate | 0.51% |

| Notice to pay rent before eviction | 5 days |

| Security deposit limit | 1.5 month's rent |

| Requirement to return deposit | 14 days |

| Notice to enter requirement | 2 days |

Colorado

With a low property tax rate and laws that protect landlord interests, there is no doubt that Colorado is a state that favors landlords.

According to SmartAsset.com, homeowners in Colorado only pay 0.48% in property tax, making it among the five lowest rates in the country. Also, there is a cap on how much property tax rates can change annually.

There are no state-wide laws that require landlords to have a rental license, but some Colorado cities have their own municipal requirements. For example, in 2021, the city of Denver passed legislation called 'Healthy Residential Rentals for All' that requires landlords to obtain a license for their residential rental properties. Landlords should always check for any local legislation that requires them to obtain a license.

Also, since 2021, Colorado limits the frequency with which landlords can increase rent. Landlords can only increase rent once per year (CO Rev Stat § 38-12-702). However, Colorado law does not limit the size of the increase or the amount that landlords can initially charge.

Landlords value their right to receive on-time rent. In Colorado, landlords only have to give tenants three days' notice to pay overdue rent before they can begin the eviction process. The same goes for other lease violations: a tenant has three days after they receive notice to remedy the issue before their landlord can initiate an eviction.

When it comes to security deposits, Colorado's laws definitely favor landlords. Currently, Colorado only limits security deposits for mobile home rentals to one or two months' rent. For other types of rental properties, such as houses or apartment units, there is no legal limit for security deposits. Also, landlords have one month after a lease ends to return the tenant's security deposit. Landlords can even extend this period to 60 days if they document it properly in the lease. This timeframe gives landlords time to thoroughly inspect their rental property for tenant-caused damage.

Colorado is landlord-friendly because landlords can set their own notice requirements for entering their properties. In Colorado, there are no specific laws regarding a landlord's right to enter their rental. However, landlords should outline a fair amount of notice in a tenant's lease to ensure they comply with a tenant's right to quiet enjoyment of their home.

| Colorado | |

| Average property tax rate | 0.48% |

| Notice to pay rent before eviction | 3 days |

| Security deposit limit | None (for most property types) |

| Requirement to return deposit | 1 month to 60 days |

| Notice to enter requirement | No statutory guidance |

Florida

Although not the lowest on this list, Florida's average property tax rate is 0.98% which is slightly below the national average. Despite not having an extremely low rate, Florida is still a landlord-friendly state due to its favorable security deposit and eviction laws.

There are no state-wide rent control ordinances in Florida. Like in all other states, landlords in Florida cannot increase rent if a tenant is on a standard fixed-term lease. However, once a lease term is over, there is no legal limit to how much a landlord can increase a tenant's rent. During month-to-month leases, landlords only have to give tenants 15 days' notice before enforcing a rent increase.

If a tenant fails to pay rent in Florida, a landlord may give the tenant written notice to pay or vacate within three days. After three days, the landlord can begin the eviction process if the tenant hasn't paid or vacated the premises.

In Florida, there are no laws that dictate how much a landlord can charge for a security deposit. Still, most landlords charge one or two months' rent. If a landlord does not use a security deposit to cover any unpaid rent or repair costs, they have 15 to 60 days to return it to the tenant.

Florida state law only requires landlords to give their tenants reasonable notice before entering. The law states that “reasonable notice” for the purpose of repair should be given at least 24 hours before entry.

| Florida | |

| Average property tax rate | 0.98% |

| Notice to pay rent before eviction | 3 days |

| Security deposit limit | No limit |

| Requirement to return deposit | 15 to 60 days |

| Notice to enter requirement | 12 hours |

Georgia

Georgia Code Title 44, Chapter 7 (2022) leaves leases relatively unregulated, allowing landlords to have more control over their rental arrangements. Also, Georgia's average property taxes are lower than the national average. According to Tax-Rates.org, Georgia's average property tax rate is 0.83%.

Georgia law prevents rent control (GA Code § 44-7-19), so landlords can set their own rental rates in their leasing agreements.

In addition, Georgia law does not require landlords to give nonpaying tenants a specific amount of notice before pursuing an eviction. A landlord can issue a notice the day after rent is due. Also, the notice does not have to be written. Unless a tenant's lease outlines a certain notice period, a landlord can determine how much time they want to give their tenant to pay before they begin the eviction process.

Georgia is a landlord-friendly state because its security deposit laws do not limit the amount a landlord can collect for a security deposit. However, landlords must return the security deposit within 30 days if it is not used to cover any costs.

| Georgia | |

| Average property tax rate | 0.83% |

| Notice to pay rent before eviction | Not specified |

| Security deposit limit | No limit |

| Requirement to return deposit | 30 days |

| Notice to enter requirement | Not specified |

Texas

According to SmartAsset.com, homeowners pay an average rate of 1.60% in property tax, making it one of the states with the highest property taxes. So, how could it possibly still be considered landlord-friendly?

Despite high property taxes, Texas' laws favor a landlord's rights when it comes to security deposits and eviction notices, making it a landlord-friendly state. In addition, Texas does not have a state-wide requirement for landlords to obtain a license. However, local jurisdictions may vary.

Texas has no rent control laws that limit what a landlord can charge for rent. This means that after a fixed-term lease ends, a landlord can increase their unit's rent by any amount.

When tenants do not pay their rent in Texas, landlords have more options than in other states. Landlords are not required by law to give them the chance to remedy the situation. So instead of having to provide tenants with a Notice to Pay or Quit, landlords can give them three days' notice to move out. Landlords still have the option to give tenants time to remedy the missed payment.

In Texas, there is no standard limit for security deposits. Landlords have 30 days after a lease ends to return the tenant's security deposit. This time frame gives landlords a moderate amount of time to thoroughly inspect their rental property for tenant-caused damage before returning the deposit.

| Texas | |

| Average property tax rate | 1.60% |

| Notice to pay rent before eviction | No requirement |

| Security deposit limit | No limit |

| Requirement to return deposit | 30 days |

| Notice to enter requirement | Not specified |

All landlords have obligations

If you are considering investing in a rental property in the United States, there are pros and cons to every state. Some states may favor you in financial ways, some states may give you more control over their properties, and some may do both.

But regardless of which states are considered landlord-friendly, all landlords are held to certain standards. For example, all landlords have to follow some federal landlord-tenant acts. These federal laws ensure the basic rights of tenants and prevent discrimination.

So even though some states are landlord-friendly, you will always have certain obligations that affect your success as a landlord. Overall, if you respect your tenants, act quickly, and stay on top of your responsibilities, you will have better luck with your rental property—no matter which state it's in.